Positive money

People will have you believe that banks and the government can print money, and all will be fine. By distributing money to the needy by means of what is called 'helicoptering cash' many ills of society can be banished will no negative consequences. If only that were so. Instead of waiting a year for apples and oranges we can print them instead, conjuring them out of thin air. If you want more apples you need more trees. It is as simple as that. Yes, it is true that increasing the money supply is needed at times, maybe to enable farmers to plant more trees. Any increase is coupled with an increase of prices though.

There are many supposed myths out there in relation to cash in the economy and the word confidence is banded about in terms of it being fragile. Confidence can indeed wane and be subject to misdemeanour. We can have false confidence and lose confidence quite quickly. Nevertheless, confidence is money and by and large it works rather well. We can't survive without confidence, confidence in ourselves and that of others. Are you confident that the food you eat is safe? Are you confident that your partner is faithful? When your confidence is betrayed things unravel.

Printing money

Ok - I am setting myself up as a bank. I can now print money. I will employ a secretary and pay them from this printed money. I will pay myself and pay for an office on the high street. I don't need savers or people coming in to borrow for I can simply print what is needed when needed ad infinitum. Clearly something is wrong somewhere or everyone will get in on this.

I have always fancied being a millionaire and make no mistake about this, I can become one instantly. All I need is someone who too wants to join the party. What will happen is this: I John will lend Susan 1,000,000 and Susan will lend me the same. I hand her an IOU and she gives me one. Now we both have a million each. But I want cash. So, I sell Susan's IOU to someone called Bob. To fast track the deal I will ask Bob for 900,000 in cash for the IOU from Susan. With all that cash I can swan off to the Caribbean. Now Susan has a problem. She can't honour that IOU and declares herself bankrupt. Bob is seriously out of pocket. The point to all this is that an IOU is based on confidence. Will they repay and honour the debt? No different to how confident you feel about lending a lawn mower to a neighbour. We increase the hire charge or take a larger deposit from those we feel less trustworthy. Governments auction bonds. The higher the interest the more likely the issue is successful. The greater the suspicion that the money won't be repaid in full the higher the interest rate needs to be to attract lenders.

Each of the many banks will have debts and credits with one another forming a spider's web trail. The more IOUs in circulation the more money in the system and it feels like they are printing it. The trustworthiness, credibility, reliability of each bank is monitored. The interest rate fluctuates according to rumour, beliefs and certain facts that come to light.

Modern Banking

In years gone by a bank would hold people's cash and lend it out. So, lots of people would receive say 3% interest on their savings and borrowers would pay 5%. The bank profits from this difference. That is all fine but when there are lots of people wanting to borrow maybe to buy a house the bank runs out of cash. It can raise the interest on the savings. It can put a big notice on the window saying 3.5% paid on your savings. This can attract more money. It lowers the profit but enables them to do more business. Deregulation in the markets took a different approach. Instead of enticing savers in, they simply borrowed big from the financial markets. For every £1 they have in savings they could obtain say £10 from big lenders, pension funds, government divestments and so on. A pension fund manager doesn't want nor has the will to lend 'small' amounts to individual borrowers. It is a wholesale financial system that is generally fine.

Where is the problem? There is no problem if things are all in proportion. So long as a bank or building society doesn't get carried away. If they lend too much to too many people that don't have the means to repay then they are in trouble. People need to borrow what they can reasonably expect to pay back.

If you found a job whereby you get paid to complete a financial deal you don't always care whether the loans are sensible or not. You sell a house with a loan for £100,000 and get a tidy £3000 commission then move on to the next. There is no come back to you, the holders of the loans lose out, not you.

Systems can be a problem, not capitalism. The book talks about what it describes as good and bad capitalism. Good being borrowing to buy more stock or tools for a business. Good in that the original money is recouped and profits made. Bad capitalism is buying a new TV by means of a loan. After a few years the TV goes to landfill or a recycling centre and the money along with the interest paid is never recovered.

I will simply say 'don't believe the hype'. It can be made to appear that more cash can be spawned by introducing more IOUs between the banks, but it is nothing other than a conspiracy theory with partial truths. Maybe a nation could issue bonds to sell to other nations with no intention of ever reimbursing them for their generosity. However, such trickery never lasts long. Anyone touting the term positive money is setting out to make you believe roads are literally paved with gold.

Cryptocurrencies are similar to printing money and are another huge con. Whilst they can be useful for transferring money from one person to another, as an investment it is a swindle. All things, houses, paintings, food, metals etc have a current market value. That value is realised if there is somebody that is actually prepared to pay a certain sum for it. The people that will always make money from cryptocurrencies are those that issue them in the first place. All others are just hoping that some other mug will pay even more for it later. There are winners, quite a few, but each winner won at the expense of a loser. It is not the same as investing in land and trees where you get a physical payback.

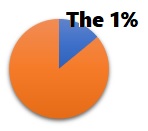

People do profit from positive money, printing money, pyramid schemes, cryptocurrencies etc, but it is always at someone else's expense. It is all too easy to make the seemingly impossible seem possible. In the case of positive money, it will be the pensioners, savers and people with a little cash that will all suffer. The rich will have plenty of assets, gold, diamonds, property etc that will rise in value. The poor will be the ones that become short changed.

You are welcome to read a book about you, me and everyone else. Some of you will get to understand what drives us all.

When you look up into the night sky you may be able to make out the odd star, but light pollution prevents you from seeing much. Go to the "middle of nowhere" and the spectacle is very different. You see it all. This book is like that. Every facet of human behaviour becomes clear, the psychology, our dreams, our aspirations, our wishes and wants. It is all uncovered.

Copyright © 2003-2019. Ignorance Paradox all rights reserved