QE I will be honest with you. It took me quite a while to get my head around QE. It is complex and confusing for sure. However, I came to realise that it is very simple. In order to understand QE, Quantitive Easing, one needs to know a little about bonds. So, I will give you a primer.

Governments borrow money. They do so largely by issuing bonds. They are sometimes referred to as gilts. They can be known as 1 year, 2 year, 5 year, 30 year bonds etc.

Bonds have a redemption value and a redemption date. For arguments sake the redemption value may be £100 and the redemption date, 31st December 2030. The redemption value is how much they will return to the holder on the redemption date. The price you pay today for the bond may be more than the redemption value or it might be less than the redemption value.

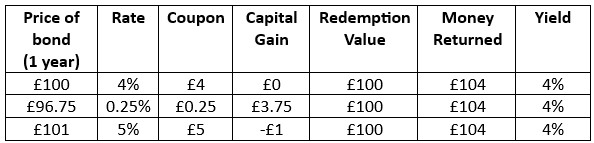

Bonds pay interest, they have what is called a coupon attached, interest, that is usually paid twice a year. A £100 bond 4% - will pay £4 per year, £2 every six months. If you pay £110 for the bond you still get £4 per year so the interest you actually get is just over 3.6% not 4%. If you paid £93 for the bond you get £4 each year which works out at just over 4.3%. This is interest not yield. If you pay £110 for the bond you get £4 each year but lose £10 on the redemption date as you will only get £100 back. More about that later.

Short dated bonds If you buy a £100 government bond 2% that has a redemption date in say 12 months' time you enter very safe bet territory. You will receive £2 in coupons. If the prevailing interest rate is say 4% you should be paying £98 for the bond. You gain £2 on the bond and get £2 coupon. £102 back. £4 profit. (These numbers are approximate but are pretty close) so long as you are happy to keep your money tied up for 1 year and are happy with a 4% gain it is a pretty safe bet. The bond price may fluctuate but in general will rise each day from £98 to £100 as it becomes ever closer to the redemption date. If you think about it, buying a bond a week or so before the redemption date, you only have to wait a week to get paid out.

A £100 bond 5% The government may issue bonds with a 5% coupon. If that is more than the prevailing interest rate 4% they auction them. They ought to get £123 for them as 5 divided by 123 = 0.04. Aka 4%. The government has to pay a higher coupon but gets a lot more cash up front. Those paying £123 will only get £100 back at the end but will get £5 each year. These bonds whilst fluctuating in price will head down from £123 towards £100 as each day/ month/year passes and gets ever closer to the redemption date. You lose £23 over the period but benefit from a relatively large coupon.

If the interest rate set by the central bank such as the Bank of England goes up say to 4.5% the price of bonds drops. The yield (interest + capital gain) will likely match the central bank interest rate. One way or another, you would get the same return on your money if you bought the bonds today as you would on savings in a bank paying 4.5%. Some bonds have a higher coupon, but less in the way of capital appreciation. Some will have a very low coupon, but you gain when you redeem them at the end. Usually, the yield is the same on all bonds with similar redemption dates. Historically, shorter dated bonds tend to have a lower yield that longer dated ones. Not always as what is called the yield curve can invert giving shorter dated bonds a higher return. That can be a signal for trouble in the country issuing the bonds.

If a bond has a 0.5% coupon the price of the bond would be under the redemption price £100. If it has one year to run, it ought to be priced at £96.50. That gives £0.50 - 50p interest and £3.50 capital gain. Yield 4% (Approx).

Risk There is always a risk that the government gets into a financial mess and defaults; refuses or is unable to pay bond holders their money owed.

Banks will guarantee to return your savings but only the first £85,000 (in the UK that is). So, some with large cash deposits may elect to hold their money in bonds rather than with a bank.

In the UK, there is no Capital Gains Tax on Gilts. That can be another attraction to savers.

Sentiment If the bond holders sense trouble ahead and worries about the ability of a government to honour its debts, they may be inclined to sell them. As they sell them the price of the bond drops. This means new buyers will get more than the prevailing interest rate. A £100 Ten Year bond 4% may drop to £95. The buyer will make a £5 gain in 10 years' time and receive £4 each year interest. Total return £45. Yield circa 4.5%. I say circa as the cash tied up in the bond drops each time a coupon is paid. It is also paid every six months too, so the numbers are slightly complicated to work out but what I have put is close enough to get an understanding of how bonds work in practice. (if something goes from £100 to £95 you lose 5% but if something goes from £95 to £100 you gain 5.02%).

QE Now to QE the magic trick that plays with your mind and your financial health. If you have read the document regarding QE on the BoE website, you may be more baffled than before you downloaded it. They hide obfuscation inside riddles. QE is not that difficult to understand, nor is the reason for doing it.

If there are lots of people selling bonds the price drops. If the government sells vast numbers of bonds in a short space of time the price drops. During the lockdowns the UK government needed to sell £400,000,000,000 worth of bonds quickly. £400bn of bonds hitting the market in a matter of months. Furlough, bounce back loans, world beating test and trace systems, you name it, was to be funded. The debt stood at about £1900bn so an extra twenty percent more.

The government instructed the Bank of England to 'print', create money. lots of it. The newly created money was handed to large commercial banks which in turn used that money to buy bonds. By buying lots of bonds they created a hole in the market in which the government can fill with new bonds. This meant that the number of bonds in circulation stayed reasonably static and therefore no major price movements were seen. Had the government issued £400bn worth of bonds without getting the banks to buy lots up, the yield would have risen rapidly. A higher yield means that the government has to find a lot more to cover the coupons and will get a lot less when they auction the bonds. Debt interest would spiral, potentially out of control.

QE is simply increasing the amount of money in circulation to buy bonds. They bought the bonds so that the bond holders would buy new ones from the government. It is way to increase government debt without immediately upsetting the market. The government has money to spend without having to raise taxes or cut services. It is not a free lunch. It has side effects and the more often it is done the more pain it causes. The idea that governments can just find money if they need to, is true, but someone has to pay sooner or later.

To simplify the concept, think about this. You can create money with a stroke of a pen. However, you can't create food, fuel, houses, roads, cars, computers etc with a stroke of a pen. One has to physically get people to make those things.

2020 debt interest stood at £30bn per year.

2025 debt interest is moving above £100bn year.

Government income stands at around £1050bn.

Close to 10% of tax receipts are handed to bond holders.

Inflation. As the money section in the Ignorance Paradox explains, more of something means the price drops. You most likely know that already. If there is more of something people sell it for less. The same goes with money, more money makes it is worth less. If it is worth less, you have to use more to pay for things. That means prices go up. Inflation.

With £400bn created, the 'value of sterling' fell. inflation came calling in the following years after the lockdowns. Lots of other nations were also using QE too at the time so the change in value of sterling to the US Dollar and Euro diffuses the inflation picture.

The Bank of England raised interest rates to stem inflation. However, it also sold many of the bonds that it bought under the QE programme. It sold them and destroyed the money. Less money, lower inflation. There were other things that the government could point to which might have been Inflationary, wars, trade issues etc. However, in a large part, the needle was shifted by QE.

Who gained, who lost? Who gained from QE? Who lost out? There are never any free lunches. Inflation leads to a rise in asset prices. Houses, gold, land, tangible things. The rich own lots of assets so would not have lost out by money depreciation. Their wealth would have risen in monetary terms and possibly in real terms too. (Something can go up in price but if your wages remain the same it is not pleasant. Real terms includes the effect of inflation, monetary terms does not).

Trading bonds. If you think interest rates are set to fall you can buy bonds in the hope that the bond price will go up. If the government unnerves the market and the bond prices fall for a while you can poach some whilst they are on sale cheap in the hope that confidence returns. More sophisticated traders can sell bonds that they do not have. They borrow bonds and sell them. When the price falls, if the price falls, they buy them back at a lower price than they borrowed them for. They hand the bonds back and scoop the difference. They have to pay a fee to borrow. They will lose out of the bond price rises and they need to buy them back for more than they sold them.

I could borrow your £100 bond. I pay you £1. You are happy as you now get an extra 1% interest on top of what you are getting. I sell the bond. The bond drops to £93. I buy the bond back on the open market. I give you the bond back. I gain £6. This is often called short selling, shorting.

Daily Interest In case you were wondering, what happens if you buy a bond a day before it is set to pay the coupon? How does it work? When you buy a bond, you will be charged the amount of interest worked out to the day on top of the bond price. On a £100 bond with a £2 coupon per six months, after say 3 months you pay £101 for the bond. Likewise, when you sell you get the portion of coupon according to how many days past the last pay out day was. You can therefore hold bonds for a short period and gain the interest. This is quite different from shares. They pay dividends periodically and those that buy the day before the "Ex-Div" day get the dividend and those buying after get nothing. However, the share price tends to get marked down by the amount of the dividend on the day it goes Ex-Div.

Money gone walkabout I traded a number of bonds in 2021. I paid £150 for them. I did ok for a while but then some tranches dropped to £145. I bailed taking a loss. I bought them all back at £96. Then recouped all losses and turned a profit when they rose to £105.

£1900bn of bonds priced at circa £140 dropping to circa £100 is some £500bn gone walkabout. Some holders will keep the bonds to maturity and make do with a typical yield of 2%. Many holders faced a huge loss if they had to sell.

A book about us; our lives.

Not the most insightful book in the world, but the most insightful book in the universe.

Copyright 2003-2025. Ignorance Paradox all rights reserved