Misleading information regarding crypto currencies

Specimen 1: A store of value - a guard against inflation.

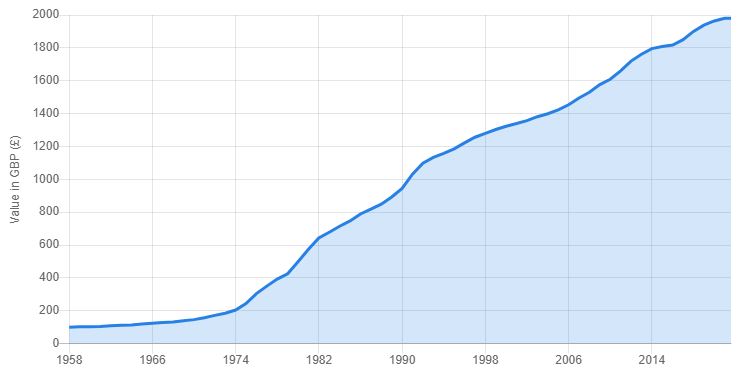

Crypto advocates are proposing that your money held in Bitcoin and other digital 'assets' will insulate you against the ill effect of inflation. It seems plausible. Over the past 62 years inflation has a devastating effect on money held under the mattress. One hundred pounds has the same purchasing power now as £5. You would need £2000 to buy what you could with £100 - sixty-two years ago. So, there is some truth in this inflation problem.

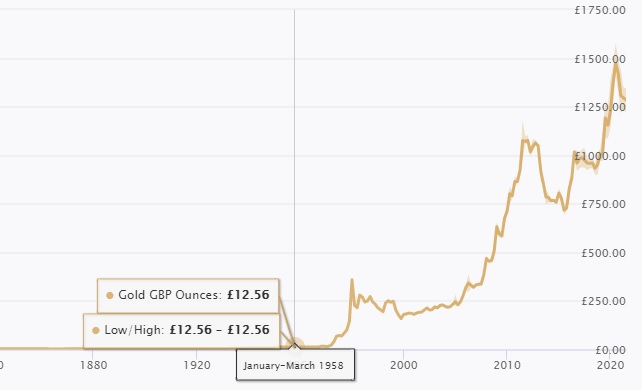

However, if you held that £100 in gold. You could have bought 8 ounces. 8 ounces today fetches £10,000. That is five times inflation. With bitcoin you have nothing tangible. With gold, at the death you can make a nice ring out of it or use it in drill bits, electrical connectors, or scientific instruments.

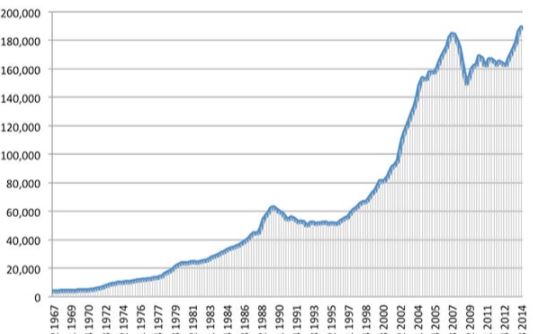

What if you put that money into property? Average house prices were around £2040 in 1958 and are £320,000 today. That is seven times inflation rate.

What if you just held it in a high interest savings account? Although interest rates have been very low since 2008, they have not always been this low. This is difficult to answer, but one thing is for sure; if you reinvested the interest your £100 would not have dropped to £5. People were getting 5% or more per year interest during the 70s/80s/90s/00s I suspect you probably would have broken even. Just because interest rates are low now, it doesn't mean they will stay that way. Most accounts are paying less than 1% well below inflation. Some coins pay interest, but they seem at a 'too good to be true' rate.

What if you bought a basket of shares? £100 invested in 1958 would be worth over £50,000 if all dividends were reinvested. You don't get much in the way of dividends with digital coins. That is twenty-five times the inflation rate.

Specimen 2: If I bought lots of bitcoin at £100 per coin 12 years ago and sold it at £60,000 - I would be a millionaire now. If, if, and if. You didn't so you are not a millionaire by all accounts. Some people with foresight did. Very few though. If you didn't bail out when it hit £1000. Lots would have seen it go up tenfold and sold out. Maybe you would have sold some and kept some. Nevertheless, most people sold well before it reached £60,000. You probably would have too.

Specimen 3: Coins bought now will be worth a lot of money in the future. The last thing the digital 'asset' community want is people taking their money out. What they want is more people buying than selling. Encouraging long term 'investment' helps keep inflows above outflows. The combined face value of all coins is some £1.5tn. It did hit £2tn. The total value of all the houses in the UK is about £9tn. So, if all that money was put into digital 'assets' then your coins could go up five-fold. It is going to take all the money in the world to get another equivalent shift from £100 to £60,000. It would need all the gold in the world, £10tn, the entire US stock market £47tn and so on.

Specimen 4: People are making money no matter what you say. Indeed, some are. For every person that makes £1 another is losing £1. Not only that but the miners have to be paid, sucking lots of cash from the system.

Specimen 5: This is the future. We will be spending it in the shops and online. Maybe. They said Flash would power every website. Now it is obsolete. Lots of things are brought to our attention with razmataz and fanfare then fade. Digital coins have been around for 13 years and will play a role somewhere, somehow. In the meantime, I have my credit card to buy things. If it gets hacked, they reimburse me. I can use it anywhere. On one of my cards, they give me 1% cashback on all purchases. It is instant. It works. It is regulated. It is reliable. It is trustworthy. I have confidence in it. Confidence that I can't find in digital currencies.

Specimen 6: I can transfer money to someone anywhere in the world very cheaply. Maybe, but if I want to send some money to a friend in Ghana it is not practical at the moment. That may change. Eventually. How does that help me decide right now to pour money into it?

Specimen 7: It is free from interference from banks and governments. That maybe so, but you are still beholden to the coin exchanges. They swap fiat money with the coins and take a cut.

Should I just put a few hundred/ thousand pounds into it just in case it rises like crazy? It is money I can afford to lose. I don't want to miss out on this chance. I repeat there is not enough money in the world to make lots rich through this. Only a small minority will win big. If you want a less risky way to make money from digital assets. Create your own and sell them. Lots of people have.

A book about us; our lives.

Not the most insightful book in the world, but the most insightful book in the universe.

Copyright 2003-2025. Ignorance Paradox all rights reserved